On 1 April 2019, car tax went up for most UK drivers when the Government introduced new vehicle excise duty (VED) rates. Owners of petrol, diesel, hybrid and electric cars will now pay more to tax their car, with only the most efficient models escaping a price hike.

If your car tax is due for renewal and you’re confused by the new rates, our guide to UK car tax bands for 2019/20 has all the information you need to make sure you’re paying the right amount.

- UK Car Tax Bands 2019/20

- Find Out How Much You Should Pay in Car Tax

- Car Tax: Why Do We Have to Pay It?

- How to Tax Your Car

- Could You Be Exempt from Paying Car Tax?

UK Car Tax Bands 2019/20

There are essentially two car tax bands you need to know: one for cars registered before 31 March 2017 and another for cars registered after.

Cars Registered Between March 2001 and 31 March 2017

If your car was registered before 31 March 2017, the tax you pay is determined by the old system, introduced in 2015. Up until April 2019, the VED rates for cars in this period remained largely unchanged. However, inflation and the retail price index (RPI) mean that tax has now increased for some 2001-2017 cars – with drivers paying between £5-£15 a year more in car tax depending on how much CO2 their car emits.

Cars Registered After 31 March 2017

The new system, which launched on 1 April 2019, introduced new VED rates for cars registered after 31 March 2017. The rates are based on CO2 emissions, inflation, and the value of the car. And to make things even more complicated, the first-year rate of tax for high-end cars (valued above £40,000) will revert to the same rate as cheaper models (valued under £40,000) after six years of ownership.

Find Out How Much You Should Pay in Car Tax

Still with us? Good, because we’ve put together the following tables to help you find out exactly how much you should be paying to renew your car tax in 2019/20. Use the links below to find the car tax figures which correspond to the year your car was first registered:

[Quick Links]

- Car Registered 31 March 2001 – 31 March 2017

- Car Registered 1 April 2017 – 31 March 2019

- Car Registered Since 1 April 2019

Car Registered 31 March 2001 – 31 March 2017

| CO2 Emissions (g/km) | Petrol and Diesel Cars | Hybrid and Alternate Fuels |

| 0-100 | £0 | £0 |

| 101-110 | £20 | £10 |

| 111-120 | £30 | £20 |

| 121-130 | £125 | £115 |

| 131-140 | £145 | £135 |

| 141-150 | £160 | £150 |

| 151-165 | £200 | £190 |

| 166-175 | £235 | £225 |

| 176-185 | £260 | £250 |

| 186-200 | £300 | £290 |

| 201-225 | £325 | £315 |

| 226-255 | £555 | £545 |

| 255+ | £570 | £560 |

Car Registered 1 April 2017 – 31 March 2019

| Fuel Type | Valued Under £40,000 | Valued Above £40,000 |

| Petrol/Diesel | £145 | £465 |

| Electric | £0 | £320 |

| Alternative Fuel | £135 | £455 |

Car Registered Since 1 April 2019

| CO2 Emissions | Petrol and Clean Diesel | All Other Diesels | Hybrid and Alternate Fuels |

| 0 | £0 | £0 | £0 |

| 1-50 | £10 | £25 | £0 |

| 51-75 | £25 | £110 | £15 |

| 76-90 | £110 | £130 | £100 |

| 91-100 | £130 | £150 | £120 |

| 101-110 | £150 | £170 | £140 |

| 111-130 | £170 | £210 | £160 |

| 131-150 | £210 | £530 | £200 |

| 151-170 | £530 | £855 | £520 |

| 171-190 | £855 | £1,280 | £845 |

| 191-225 | £1,280 | £1,815 | £1,270 |

| 226-255 | £1,815 | £2,135 | £1,805 |

| 255+ | £2, 135 | £2,135 | £2,125 |

Car Tax: Why Do We Have to Pay It?

Car tax is used to fund environmental improvement schemes, local projects and other things, like infrastructure. And, as of 1 April 2019, it’ll also be used to support the National Road Fund – a £30 billion spending pot which will be devoted to improving the UK’s motorways, A-roads and other major routes.

Traditionally, the upkeep of roads was paid for by council tax and income tax, with VED only charged for tailpipe emissions of CO2 from petrol and diesel vehicles. However, going forward, a portion of all car tax will be ring-fenced to support the National Road Fund – a move which many drivers hope will go some way into solving the UK’s pothole problem.

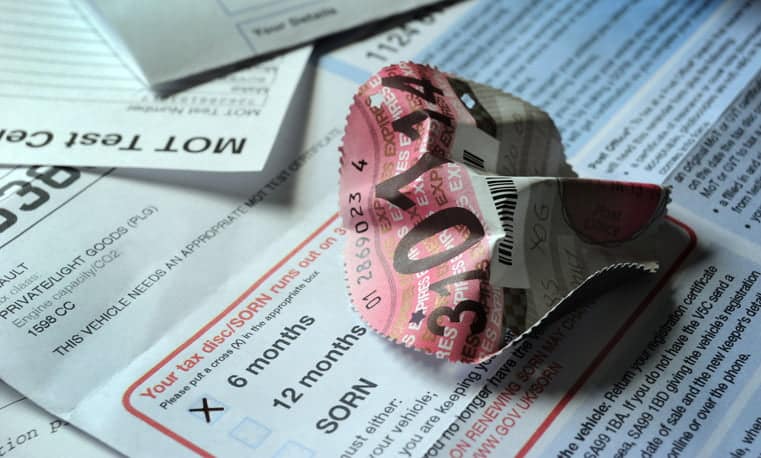

How to Tax Your Car

Taxing a car may be more expensive now, but it’s definitely easier than it used to be. You can do it all online and you don’t need a tax disc, and flexible payment options mean you won’t need to scrimp and save when your car tax is due.

Here’s a step-by-step guide to taxing a car in the UK.

Step 1

To tax your car, you’ll first need a reference number. This can be found on documents like:

- A V11 car tax reminder form from the DVLA

- The vehicle logbook (V5C) in your name

- The new keeper details slip (V5C/2) from a logbook if you’ve just bought the car

You’ll also need to find out the year it was first registered; you can find this information quickly using the government’s check vehicle tax tool.

Even if you’re exempt from paying tax, you still need to tax it. You can do this by following the same steps listed below.

Step 2

Head to the gov.uk vehicle tax portal. This is where you can tax your car, work out how much tax you owe using a calculator, and get more information about whether you’re exempt from paying tax.

Step 3

Follow the instructions and have your 11-digit reference number ready. The system will find your car and work out how much you owe based on this number. You’ll then be asked to pay via debit/credit card or Direct Debit.

Step 4

Once you’ve paid the car tax or set up a payment plan, your car is officially taxed, and you should get a confirmation email from the DVLA. You don’t need to display a tax disc or do anything else.

If you want to check that your vehicle is taxed and when the tax is due for renewal, you can use this tool. This also tells you when the MOT is due.

Could You Be Exempt from Paying Car Tax?

Depending on the type of car you drive and your own circumstances, you might be exempt from paying car tax. Here’s the criteria for car tax exemption:

- If you drive a brand-new car that makes 0 g/km of CO2 and is worth less than £40,000

- If you drive a car registered between 1 March 2001 and 1 April 2017 that produces less than 100 g/km of CO2

- If you have a disability, car tax is free in some circumstances, including if you have a mobility scooter, receive the higher rate of Disability Living Allowance, or receive a War Pensioners’ Mobility Supplement.

- If you drive a classic car that’s over 40 years old

For more of the latest motoring advice and how-to guides, check out the rest of the Holts blog. If you’re looking for info on our DIY car maintenance tools and products, visit the homepage today.